A powerhouse panel of experts presented the latest wine industry statistics and trends at the Wine Market Council’s data-packed three-hour session on March 20 at Copia in Napa, Calif. Several hundred attendees heard presentations from trend expert Danny Brager (wine business analyst and former SVP of Nielsen’s Beverage Alcohol Practice Area); market researcher Christian Miller and Dr. Liz Thach, MW, president (both of the Wine Market Council); and multicultural marketing data expert Mike Lakusta of EthniFacts.

1. Alcohol Consumption is Lower Across the Board

While the industry is seeing decreasing wine sales, Miller stated the culprit is not due to any one specific cause, though he presented many factors in his research. Instead, he said, Americans are just drinking less alcohol than they used to.

“Reduction has a wellness component and an economic component,” he said, noting wine’s higher price per serving compared to other options could be a factor.

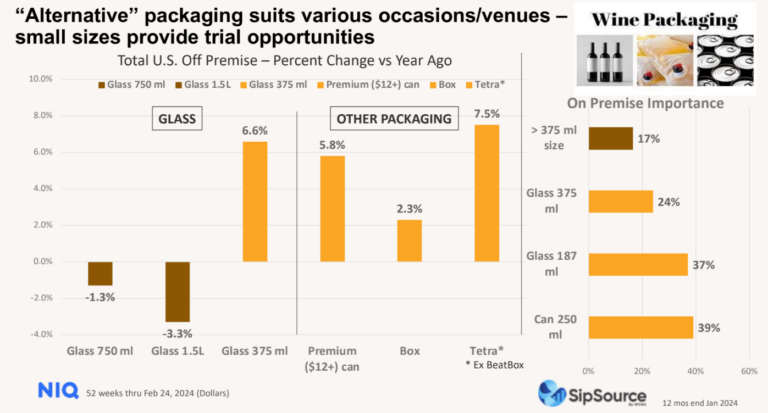

2. Alternative Packaging is a Growth Opportunity

Wines in single serving sizes and alternative materials are a growing portion of the market, according to Brager. Citing NIQ data, glass in 375 ml bottles grew 6.9% while Tetrapaks grew 7.5%. SipSource data from on premise showed a dramatic increase of 37% for wine in 187 ml glass bottles and 39% for wine in 250 ml cans.

Additional data from Miller and Wine Market Council fleshed out this trend. It showed 22% of the 1,584 consumers it surveyed bought 175 ml single serving wines followed by 20% who bought 375 ml bottles. Large bottles (1.5 L) placed fourth at 17%, and 16% bought wine in cans.

3. Gen Z Drinkers’ Tastes Really Are Different: Pink, Sparkling and Sweet Are Top Picks

While the newest generation of drinkers, Gen Z (21 to 26) drink less wine than other groups, when they do drink wine, they prefer pink, sweet or sparkling wines. Moscato, dry rosé, sparkling rosé, pinot gris and sweet rosé topped their list of favorites.

4. Social Media and Digital Apps, Including TikTok, Still Gaining in Popularity

Wine Market Council reported while Facebook, YouTube and Instagram were the most popular platforms used more than once a week, 40% of those surveyed watch TikTok often and 17% of respondents use wine apps.

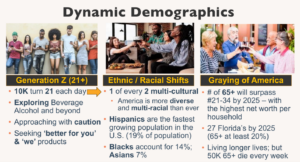

5. Multicultural Demographic Shifts: Younger Drinker Have More Diverse Tastes and Cultures

A market research overview showed that the future of the wine industry depends on wine’s appeal to the biggest emerging demographics, who are more diverse than previous generations of wine drinkers. In fact, 23% of the population are either Hispanic or black. Asians represent another 7%.

Attracting Younger and Multicultural Consumers to the Wine Category

While Miller presented exact data on ethnicity trends in wine consumption, the event showcased Lakusta and a panel of four experts to provide a broader view of consumer categories.

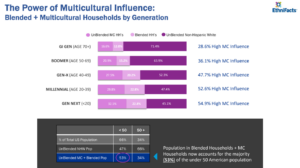

Lakusta said the blended household is key to understanding how much various cultures (and combination households) are affecting the wine industry. He’s worked with leading companies, including Diageo, on market research on multicultural trends.

According to his data, America has already reached a tipping point where 53% of households are culturally or racially blended.

Panelists illustrated the impact of these trends in their businesses, marketing wine successfully to growing demographic groups.

Stella Rosa: Unique Sweet, Spicy and Fruity Flavors

Chris Riboli, vice president at Riboli Family Wines and its San Antonio Winery, located in East Los Angeles, relies on imported Italian wines for its successful Stella Rosa brand. It’s one of the 30 largest wineries in the U.S., making seven million cases annually in the $12+ price range. Moscato in various guises dominates. Stella Rosa has 40 different semi-sweet sparkling and semi-sparkling wines, and its Pineapple & Chili wine became the bestselling new wine in the U.S. in 2023. Other unique flavors include Rosa Watermelon, French Vanilla, Blackberry, Orange Fusion and Ruby Rosé Grapefruit.

He recommends labeling wine bottles in both English and Spanish for broader appeal.

Black Winemakers Gain Momentum: African American Vintners Organization

Executive Director of the Association of African American Vintners (AAAV) and wine country transplant Angela McCrae began her interest in wine as a Boisset Ambassador, selling wine for a 25% commission when she lived in New York. She launched a wine and lifestyle magazine aimed toward black winemakers and wineries and consults to brands on inclusivity.

AAAV held its first Napa event at the Culinary Institute of America in March.

Ceja: From Vineyard Workers to Premium Winemakers

Dahlia Ceja of Ceja Vineyards profiled her Mexican-American family’s journey from Napa farmworkers to Napa vintners. They’ve had success in marketing their high-end wines ($38 to $150) to Mexican restaurants and are currently building a new winery in Napa’s Carneros region. The winery was featured in a Harvard Business School case study on marketing to the Hispanic wine consumer.

The winery is currently working on a cookbook and offering fans the opportunity to join its 2025 Portugal to Spain Douro River Cruise.

Scheid: “Better for You” Equals Better for Sales

Heidi Scheid shared her journey in the healthier, “better for you” wine category describing how she conceptualized and launched the Sunny with a Chance of Flowers brand, known for its lower alcohol (9%), low calories (85 per 5 oz serving) and labeling transparency.

“I wanted positivity,” she said of the branding.

The label has grown from 11,000 cases when it launched in 2020 to 100,000 cases in 2023, winning an IMPACT award for its growth trajectory.

Lakusta challenged producers to pay close attention to demographic trends.

“For the last six years, in the non-Hispanic white population, deaths have already exceeded births,” he said.

“Everybody in this room who’s under the age of fifty, 53% of you already today, not 20 years from now, live in a household that’s either blended or multicultural. So what we’re talking about today is not niche marketing.”