In the first four months of this year, the federal government refunded over $21 million in alcohol taxes and duties to subsidize imported wine. It is likely most of those dollars went to a few of California’s largest wineries. In the first five months of this year, over 20 million gallons of imported bulk wine poured into California. In the past five years, 1.3 billion bottles of wine have been imported in bulk. This excess wine has flooded the market and driven down demand for California-grown wines and grapes. Today, many California wineries have tanks full of wine they cannot sell in bottle or bulk. Some growers have been farming all season without a home for their grapes. Vineyards are being torn out across California and many ag workers are losing their jobs. U.S. trade policy, specifically wine duty drawback, has helped create this mess by subsidizing imports for the benefit of a few global alcohol companies.

U.S. Trade Policy Changed

In 2003, the United States changed trade regulations, allowing for a refund of duties and excise (alcohol) taxes paid on imported wine if the winery exported “interchangeable” domestically produced wine, which refers to still wine of the same color with less than 14% alcohol by volume, having a price difference less than 50% between the imported wine and the exported wine. (Exports to countries the United States has a free trade agreement with (e.g., Canada, Mexico) do not qualify as matching exports for duty drawback. The data suggest there has been significant diversion of bulk exports from Canada to Europe to qualify for the subsidy.) Simply put, if a winery imports a million gallons of Australian Chardonnay and exports a million gallons of California white wine, they can claim a drawback or a refund of up to 99% of the duties and excise (alcohol) taxes paid on the imported Chardonnay. This imported bulk wine ends up on American store shelves virtually tax free and gives the selling wineries a competitive advantage over the thousands of other wineries trying to sell in domestic markets.

Subsidizing Imports

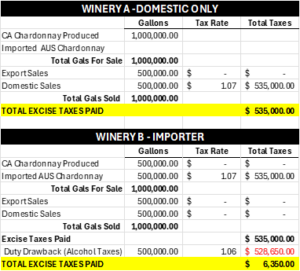

Table 1 illustrates how duty drawback subsidizes imports at taxpayer expense. Winery A produces one million gallons of California Chardonnay and sells half of it in export markets and half in the United States. Winery B produces 500,000 gallons of California Chardonnay and imports 500,000 gallons of Australian Chardonnay. Winery B also sells half the wine in export markets and half in the United States. Although both wineries sell the same amount of wine, Winery B receives a $528,650 tax benefit for importing Australian Chardonnay. Duty drawback gives it a competitive advantage over all U.S. wineries that do not import.

Additionally, Winery B has five years to find matching exports to claim the tax refund. So, if Australia, Chile, Spain, Italy, or any wine producing country has excess supply and begins dumping wine, Winery B can import large volumes of bulk wine instead of buying California grapes. They then have five years to match those imports with interchangeable exports, essentially driving down demand for domestically grown grapes. Any emerging shortages for California-grown grapes are quickly tamped down by sourcing overseas bulk wine. This business practice is legal and is being subsidized by the U.S. federal government.

Federal Policy Drives Down Demand and Price for California Grapes

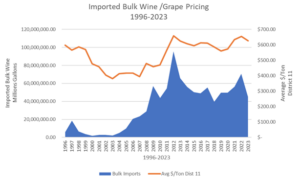

Figure 1 illustrates total bulk wine imports to the United States and the average price of grapes in Crush District 11 (Lodi) from 1996 to 2023. The shaded blue area represents bulk wine imports and the orange line represents the average price of grapes. The change of U.S. trade policy in 2003 led to an explosion of bulk wine imports from virtually zero in 2003 to 95 million gallons in 2012. That’s the equivalent of 558,000 tons of California grapes that were not purchased while millions of dollars were shipped overseas and not invested in local communities.

Also note the spikes in bulk wine imports coincide with a rise in grape prices. As demand starts to grow for California grapes and prices start to rise, many of California’s largest wineries expand bulk imports, driving grape prices down. The pattern is identical across Crush District’s 12, 13, 14 and 17. The grape prices in the graph are nominal and don’t account for inflation.

Table 2 adjusts the 2023 grapes prices to 2014 levels utilizing the consumer price index. The loss of economic activity for California grape growers and their local communities is staggering, and all this is happening with the assistance of U.S. trade policy that is subsidizing imports.

Duty Drawback’s Lack of Transparency

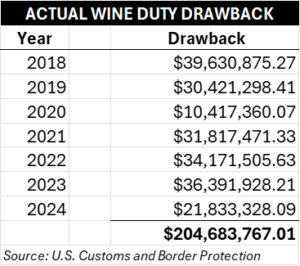

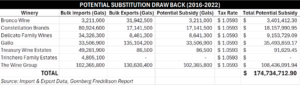

Table 3 shows the annual wine duty drawback dollars paid to importers of foreign wine from 2018 to 2024 as reported by the U.S. Customs and Border Protection (CBP). To claim the drawback, the importer must export interchangeable domestically grown wine within five years of importing. Additionally, CBP reported in their 2018 Notice of Proposed Rulemaking, “In fiscal year 2015, CBP paid $54.9 million in excise tax collection from wine imports of $335 million.” That represents 16.4% of all excise (alcohol) taxes collected on imported wine that fiscal year.

This data was not easy to access, and the lack of transparency on this government subsidy does not instill confidence the program has broad benefits. I’ve also been told CBP cannot provide data any further back than 2018 when CBP changed systems.

Multi-Million Dollar Subsidy for California’s

Largest Wineries

To understand which wineries are potentially benefiting from substitution duty drawback, we must look at detailed import and export shipments by California wineries.

Table 4 summarizes annual bulk wine imports and exports by California’s largest wineries from 2016 to 2022. The table also shows the potential subsidy or duty drawback that can be claimed. Any claim on imports must be matched by interchangeable exports. Currently, California’s largest wineries represent 95% of bulk exports and 79% of bulk imports. More current data is unavailable.

The $174 million in potential duty drawback subsidies aligns closely with the $204 million in actual duty drawback paid out over the past 6.5 years. The data also suggest it is highly probable that most of the duty drawback payouts are going to a handful of California’s largest wineries. And over half the total could likely be going to one winery.

Bulk Wine Imports Supercharged by Federal Subsidies

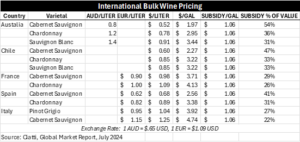

The low value of bulk wine imports creates a significant duty drawback subsidy for global wine companies.

Table 5 presents a snapshot of international bulk wine prices as reported by Ciatti in their most recent Global Market Report. The $1.0593/gallon subsidy on bulk imports represents a significant percentage of the value of the wine. The lower the cost of the wine, the more substantial the subsidy. For example, the potential duty drawback claims on imported bulk Australian Cabernet Sauvignon represents up to 54% of its value. Comparatively, the average price per gallon of bottled French wine imported in 2023 was $44.24/gallon. The duty drawback subsidy on the bottled French wine would only represent 2.4% of its imported value. The current duty drawback scheme provides a significant stimulus to bulk wine imports.

Proponents of Duty Drawback Suggest It Stimulates Exports

Proponents of substitution duty drawback claim that it helps California exports. The reality is it only benefits those wineries that are also importing interchangeable wine. The data show it is likely only benefiting a handful of global wine companies. Additionally, the downstream damage to the domestic grape and bulk wine market far outweighs the benefits. Millions of gallons of bulk wine are still pouring in from overseas while California bulk wine goes unsold, grapes go unharvested and rural communities struggle.

CBP, the federal agency that manages duty drawback claims, has observed “economic effects of the practice do not support the view that it is an effective or efficient export promotion measure.” The agency continues, “Imported wine that benefits from double drawback enters the U.S. market with a substantial tax advantage over domestically produced wine.”

In 2018, CBP analyzed wine trade data from 2004 to 2016 to delineate the effects of this double duty drawback. They concluded, “In 2004, imported bulk wine accounted for 0.9% of domestic consumption. By 2016, imported bulk wine accounted for 6.2% of domestic consumption. By volume, imports of bulk wine grew 875% over that time period… the total volume of wine exports only grew by 5.5% over that period.”

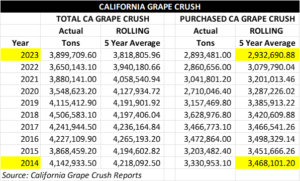

Additionally, as the total wine market continued to grow over the past decade, the total California winegrape crush and winegrape purchases from independent growers shrunk.

Table 6 details the total California grape crush for the past 10 years. The “Purchased CA Grape Crush” columns on the right reflect tons purchased from independent grape growers and eliminates winery-owned acreage. The “5 Year Average” columns reflect a five-year rolling average of grapes crushed and grapes purchased for wine production. Subtracting 2023 purchase levels from 2014, California wineries have decreased grape purchases by over 500,000 tons annually over the past 10 years. This outsourcing of winegrapes is being aided by substitution double duty drawback.

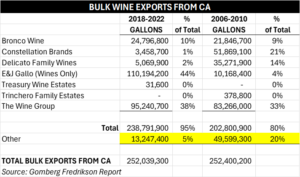

Other Domestic Wineries Squeezed Out of Export Markets

The data also suggest the duty drawback program is crowding out opportunities for non-importing wineries in export markets. In Table 7, “Other” California wineries’ share of the bulk export markets has dropped from 20% to 5% over the past 15 years. It’s highly probable a bulk importing winery would cut their price to make a bulk export deal work and thus be able to claim duty drawback on excise (alcohol) taxes paid on past imports. This practice squeezes out other wineries and is likely driving down price and value for everyone, including the growers that are told by their largest buyers they can’t pay more for the grower’s grapes because they can’t raise the price of the wine. Only the largest businesses benefit from such a race to the bottom.

Congress Needs to Act

CBP has recognized the double duty drawback loophole and has urged Congress to correct it. On Oct. 15, 2009, CBP and the Tax and Trade Bureau proposed related rulemaking to eliminate the double duty drawback. After public comment, including a statement from 18 legislators, the proposed amendments were withdrawn on March 10, 2010.

On Aug. 2, 2018, CBP proposed rules to implement changes to the drawback regulations as directed by the Trade Facilitation and Trade Enforcement Act of 2015. On Dec. 18, 2018, after public comment, the proposed regulations with amendments were adopted, prohibiting double duty drawback.

However, in 2019, the National Association of Manufacturers and The Beer Institute filed lawsuits against the updated regulations in the U.S. Court of International Trade. The court ruled in their favor, invalidating the regulations that would have ended double duty drawback. “The court notes that defendants made seemingly valid policy arguments for why the ‘zeroed excise tax’ scheme should not be permitted. But statutes cannot be constructively amended through agency action; such power lies with Congress.” That ruling was upheld (Federal Circuit Strikes Down Treasury Regulations Limiting Drawback Refunds on Beer and Wine Exports | International Trade Insights) in the U.S. Federal Circuit Court on Aug. 23, 2021.

Not only did that ruling allow double duty drawback to continue for wine importers/exporters, but it opened the door for beer, wine, spirits and tobacco producers to import interchangeable foreign products virtually tax-free, putting domestic production at a competitive disadvantage and potentially costing taxpayers billions of dollars annually.

The Dirty Secret Must End

Wine substitution duty drawback is an anti-local, anti-domestic government trade policy that, for the past 20 years, has stimulated significant damage to the health of the California winegrape market. This destructive policy subsidizes California’s largest wineries to replace California-grown grapes with imported cheap bulk wine. This is not just a Central Valley problem; the excess wine drags the whole industry down, exacerbating all of California’s current inventory and supply challenges.

Additionally, this allows wineries to circumvent California’s environmental and social regulations by importing wine from countries without similar stringent standards. And runs counter to California and the U.S. carbon reduction goals by shipping tens of thousands of containers across the world instead of purchasing local grapes. In no world does it make sense for the U.S. federal government to subsidize imported bulk wine while California grapes go unharvested, wineries go out of business and ag workers lose their jobs. It’s time for this to end.

This article was originally published on the Lodi Winegrape Commission blog.

References

Federal Register, Vol. 83, No. 242, December 18, 2018, page 37898. https://www.govinfo.gov/content/pkg/FR-2018-12-18/pdf/2018-26793.pdf

Starting in 2023, the state of California passed legislation allowing wineries to opt out of making their winegrower returns public information.

Federal Register, Vol. 83, No. 149, August 2, 2018, Proposed Rules, pages 37894-370901. https://www.govinfo.gov/content/pkg/FR-2018-08-02/pdf/2018-16279.pdf

United States Court of International Trade, January 24, 2020, pages 19-20. https://www.cit.uscourts.gov/sites/cit/files/20-09.pdf

Federal Register, Vol. 83, No. 242, December 18, 2018. https://www.govinfo.gov/content/pkg/FR-2018-12-18/pdf/2018-26793.pdf

United States Court of International Trade, January 24, 2020, page 21. https://www.cit.uscourts.gov/sites/cit/files/20-09.pdf