Move over big-brand boxed wines, there’s a new kid on the shelf. And it appears to be the higher-priced spread. Though it’s still a niche category, boxed wine from established, artisanal, boutique wineries (think Bedrock, Ryme Cellars and Tablas Creek) or entrepreneurial boxed wine-only startups (Juliet and Really Good Boxed Wine) is hitting the market. Though their sales are small (up to 10,000 cases for one of the startups), there’s growing consumer excitement in ditching the glass bottle yet still drinking more upscale wine.

During the pandemic, big-brand boxed wine sales grew quickly, with volume sales increasing 30% between 2018 and 2023. Consumers like its convenience. They can drink a glass or two at a time and never feel guilty when the rest of a glass bottle of wine goes bad. Boxed wine not only weighs less, reducing shipping costs, but compared to a glass bottle of wine, the carbon emissions are 84% less, experts say.

Better-quality boxed wine has been very widely accepted in Europe. French authorities report 44% of French wine is sold in boxes. Swedish wine drinkers drink more boxed than bottled wine.

In the U.S., it’s legal to take boxed wine to parks and pools where alcohol is permitted but glass is prohibited.

Co-Packers’ Bag Filling Operations Scale Down to Lower Minimums

For small to medium wineries in the U.S., boxed wine production is fanning out into more tiers of wine production.

In the early days, artisanal entrants like Bedrock, Rhyme Cellars, Tablas Creek and Winery Sixteen 600 spent days hand-filling plastic bags in their first boxed wine releases. Now, producers are migrating to Napa-based co-packers who have automated or semi-automated bag filling lines. Those facilities now will do boxed wine runs with minimums starting at around 1,200 cases. One producer is even doing a run of 600 cases.

“We’re seeing twice as many customers in terms of the number of clients.” said Max Franks of Sonoma Bespoke Services, which despite its name is now located in Napa. “It’s red hot.”

Entrepreneurs Launching New Boxed Wine-Only Brands

Leading the pack in the race to catch the better boxed wine wave at scale are two boxed wine-only entrepreneurial companies: Juliet, focused on female wine lovers looking for a bit of luxury, and Really Good Boxed Wines, which offers vineyard or sub-appellation designated wines for lower prices than equivalent wine in glass bottles.

Juliet’s tag line is “Boxed Wine Reimagined,” and it puts a little bit of a luxury spin on its wines, partnering with MGM resorts who feature it poolside. Started by two New York City friends, Juliet sells 1.5-litre boxed wine ($35) made by a partner in Santa Barbara County.

The brand’s hook? The packaging. The bags are housed inside cylindrical cardboard cases, festooned with Mediterranean imagery, and a little rope carry handle. The shape was inspired by liquor gift boxes that co-founder Allison Luvera was familiar with when she managed luxury spirits brands for Pernod Ricard.

The box also features a handy way to keep wine cool: a space inside the box to put ice or freezable pouches. Luvera says this feature was designed to keep white or rosé wines chilled poolside or on the go at soccer games and other outdoor events.

Really Good Boxed Wine is another new entrant in the boxed wine-only category. It’s betting on single-vineyard or sub-appellated wines to differentiate and anchor the brand. Founded by Jake Whitman, an investor with a history in managing consumer brands at Proctor & Gamble, and Amy Troutman, a wine industry veteran consultant, it’s the only boxed wine committed to single-vineyard or sub-appellated wines.

Both brands are finding online consumers are not only receptive but enthusiastically embracing boxed wines for convenience and quality. Both companies report repeat business is strong. According to Troutmiller, almost 40% of Really Good Boxed Wine’s online customers reorder wines.

How Small- and Medium-Sized Wineries Can Get into Boxed Wine

Wineries can now opt to package their current wines in bag in box format using a co-packer who takes care of the bag filling aspect and keeps the wine sound in the process. Automated systems like the one at Sonoma Bespoke Beverages produce the highest quality but have restrictions on nonconforming box shapes. Alternatively, Infinity Bottling in Napa with semi-automated filling can accommodate irregular box shapes. Both have been highly recommended by clients, including Field Recordings (for Bespoke) and Tablas Creek (for Infinity).

While ready-to-drink beverages like agave margaritas get the lion’s share of private labels, for instance, there’s room for a lot more variation in the marketplace, experts say. “We’re seeing a lot more premium wine going into bag in box,” Franks said. “Some are in the $60 to $80 range.”

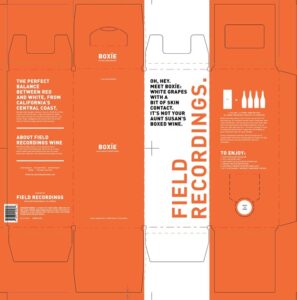

Andrew Jones at Field Recordings sells his orange wine, Skins, under his Boxie label and is increasing production to 4,000 cases this year. That’s 60% more this year than last year. He recommends a minimum commitment of 1,200 cases for a start.

Box design is another part of creating a boxed-wine brand. The box gives brands lots of space to communicate the brand’s messages, tout boxed wine’s advantages and educate consumers on why boxed wine is better.