Sauvignon Blanc was already being touted as “the coolest wine on the planet” and “the toast of the wine world” when the Lake County Winegrape Commission held its international 2018 Sauvignon Blanc Experience in Kelseyville, Calif.

Now, six years later, Sauvignon Blanc’s star is still ascending. The white wine has grown increasingly popular among consumers, bucking the current trend of stagnating U.S. sales in both red and rosé wines, according to Debra Sommerfield, LCWC president.

As a result, “wineries statewide have been really leaning in to meet consumer demand, so California’s growers have responded by planting more,” she said.

That vineyard response, however, has some California industry insiders worried.

“If the industry starts to slow down overall, do we really have room for that extra production?” asked Jeff Bitter, president of Allied Grape Growers, a marketing cooperative of 500 winegrape growers. The long-time industry executive has been pushing for more vineyard acreage to be removed from the Golden State to help bring supply and demand back into better balance.

By the Numbers

A few numbers highlight Sauvignon Blanc’s upturn. From 2019 to 2022, the white varietal’s acreage in California increased by 1,192 acres, Sommerfield said, based on the California Grape Acreage Report for 2022, released last April. Overall, statewide vineyard acres planted to Sauvignon Blanc equaled 16,889 as of 2022.

Further, the grape’s total tonnage in California has swelled by nearly 30% since 2020, according to recent data from Ciatti Company, a global wine and grape brokerage firm.

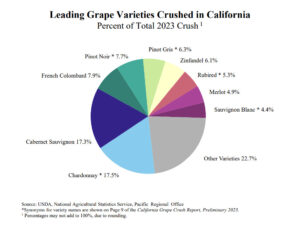

In addition, the 2023 Grape Crush Preliminary Report, released earlier this year by CDFA, showed the state crushed 162,765 tons of Sauvignon Blanc in 2023, almost 32,000 tons more than the year before.

Higher yields likely accounted for some of that increased tonnage as was the case for most California winegrapes last year. But more plantings are a big part of Sauvignon Blanc’s larger production, Bitter said. He worries if overall wine-consuming habits don’t pick up, there could be an oversupply of Sauvignon Blanc in the next few years.

Already, Bitter foresees a 29% increase in California’s Sauvignon Blanc bearing acreage by 2026 in vineyards producing the varietal for the $11- to $25-per-bottle category. That price segment is where the lion’s share of Sauvignon Blanc heads. If all bottled price points are calculated, Bitter estimates California will see a 14% increase in bearing-acreage growth for the varietal over the next three years.

“We need to be careful not to plant too much Sauvignon Blanc,” Bitter said.

Another voice of caution comes from Joy Merrilees, vice president of production for Shannon Family of Wines. The company farms 1,200 acres of winegrapes in Northern California’s Lake County and produces 14 brands of wine including its flagship Clay Shannon label. The vintner has expanded its volume of Sauvignon Blanc by 10% over the last two or three years, with the varietal now making up 30% of its overall acreage. Even so, Merrilees advised growers not to “get ahead of the market.”

“When growers see small upticks, they jump on it, and a lot of people plant,” she said. “Then oversupply comes into play. Be cautious about planting Sauvignon Blanc. The trend is alternative whites. Look for other alternative whites that may also become popular in the future.”

The Market’s “Hottest” Grape

Amid overplanting concerns, many still view Sauvignon Blanc as one of the bright spots in the troubled wine industry. Although it’s long been overshadowed by Chardonnay in both supply and demand, Sauvignon Blanc is giving a relatively robust market performance. Lake County’s Sommerfield pointed to a November 2023 article in Wine Spectator, which reported Sauvignon Blanc sales rose 1.2% to 16.6 million cases in 2022. Both imported and domestic Sauvignon Blanc sales grew.

“No grape is hotter in today’s market,” writer Mitch Frank noted.

That growth isn’t a fad, Sommerfield added. “Consumers aren’t buying Sauvignon Blanc because it’s trendy or some sort of status symbol or because everyone else is,” she said. “Rather, they’re buying Sauvignon Blanc because they actually enjoy it. It’s delicious with or without food. It fits into all social settings and is also perfect for a night in. And, because there are so many styles of Sauvignon Blanc and a bottle isn’t crazy-expensive, it’s really fun to try different ones, to discover. It’s sort of low-risk, high-reward.”

Sommerfield gave two reasons for Sauvignon Blanc’s new demand. First, there’s the “pandemic effect,” when people stuck at home discovered Sauvignon Blanc as an “affordable, approachable wine for daily drinking,” she said. Second, younger drinkers who were exploring new wine varieties, “the “not-their-parents wine effect,” and looking for crisp, aromatic wines found Sauvignon Blanc.

Consumers aren’t the only fans of Sauvignon Blanc. Vintners also like the varietal not just for its fresh, clean taste but because “it’s probably the first wine that’s done, bottled and out the door every vintage,” Merrilees said. “So you get to see the fruits of your labor so quickly, which is satisfying to a lot of winemakers.”

“Sauvignon Blanc’s got a nice cash flow to it because you’re bottling it and selling it a little earlier,” agreed Ciatti Company’s Glenn Proctor, who works closely with California’s wine industry.

A Vineyard Favorite

Sauvignon Blanc also has admirers among growers like Craig Ledbetter. He is vice president of sales and a partner with Vino Farms, which farms about 17,000 acres of winegrapes throughout California. The enterprise has increased its production of Sauvignon Blanc over the last four years, including about 100 acres of new plantings in the Lodi area and another 60 acres near Paso Robles.

“I love growing Sauvignon Blanc because it’s easy to farm,” said Ledbetter, who himself prefers drinking Sauvignon Blanc to Chardonnay. “It’s not a difficult varietal. Where you’re going to make your money in Sauvignon Blanc as a grower is in the production because it’s a good producer. You’re not having to spend excess money on protecting the grapes from the different things the environment can create like mildew or pests. Sauvignon Blanc grapes seem to be able to withstand those.”

As demand has increased, so too have Sauvignon Blanc per-ton prices. Ciatti Company numbers show California’s overall average prices for bulk Sauvignon Blanc grapes rose from $942/ton in 2020 to $1,132 in 2023. That compares with Chardonnay’s per-ton price, which averaged $842 in 2020 and climbed to $1,071 in 2023.

“You’ll see some Napa Sauvignon Blanc deals get close to $4,000,” Proctor said.

Of course, where Sauvignon Blanc, or any winegrape, is grown matters, as does quality. In general, the lower the yield, the higher the fruit quality. Wineries are willing to pay growers more for higher quality. For example, the interior Central Valley grows most of the Sauvignon Blanc grapes destined for the lower price point of $6 to $11 per bottle. The average yield for the varietal in the valley’s San Joaquin County is 12 to 18 tons per acre; the average per-ton price paid was $601, according to the 2023 Grape Crush Report.

In contrast, most Sauvignon Blanc grapes grown for higher per-bottle price points are produced in the coastal growing regions like the North Coast, including Lake County. Sauvignon Blanc’s average yield in Lake County was just 6 to 10 tons/acre, but the average price paid to growers was significantly higher at $1,319/ton.

Despite Sauvignon Blanc’s growing popularity, Proctor echoes other voices recommending growers be careful about planting more in hopes buyers will come.

“Sauvignon Blanc is establishing itself as a major white varietal, but be cautious about putting the cart before the horse,” Proctor said. “We want to be excited about Sauvignon Blanc but not overshoot the mark in production. You’ve just got to be sure the market wants it.”